- Blog

- How to Import a Car to Finland

How to Import a Car to Finland

Learn how to import a car to Finland step by step. From documents to taxes, this guide covers everything you need to start importing used cars from the EU.

Importing and reselling used vehicles in Finland can be a profitable business for dealerships, as long as you know how the process works and what paperwork is required.

So, let’s see what rules you have to follow to stay compliant with local regulations, avoid unexpected tax charges, and get your vehicles registered and ready for sale.

Get to know the Finnish used car market

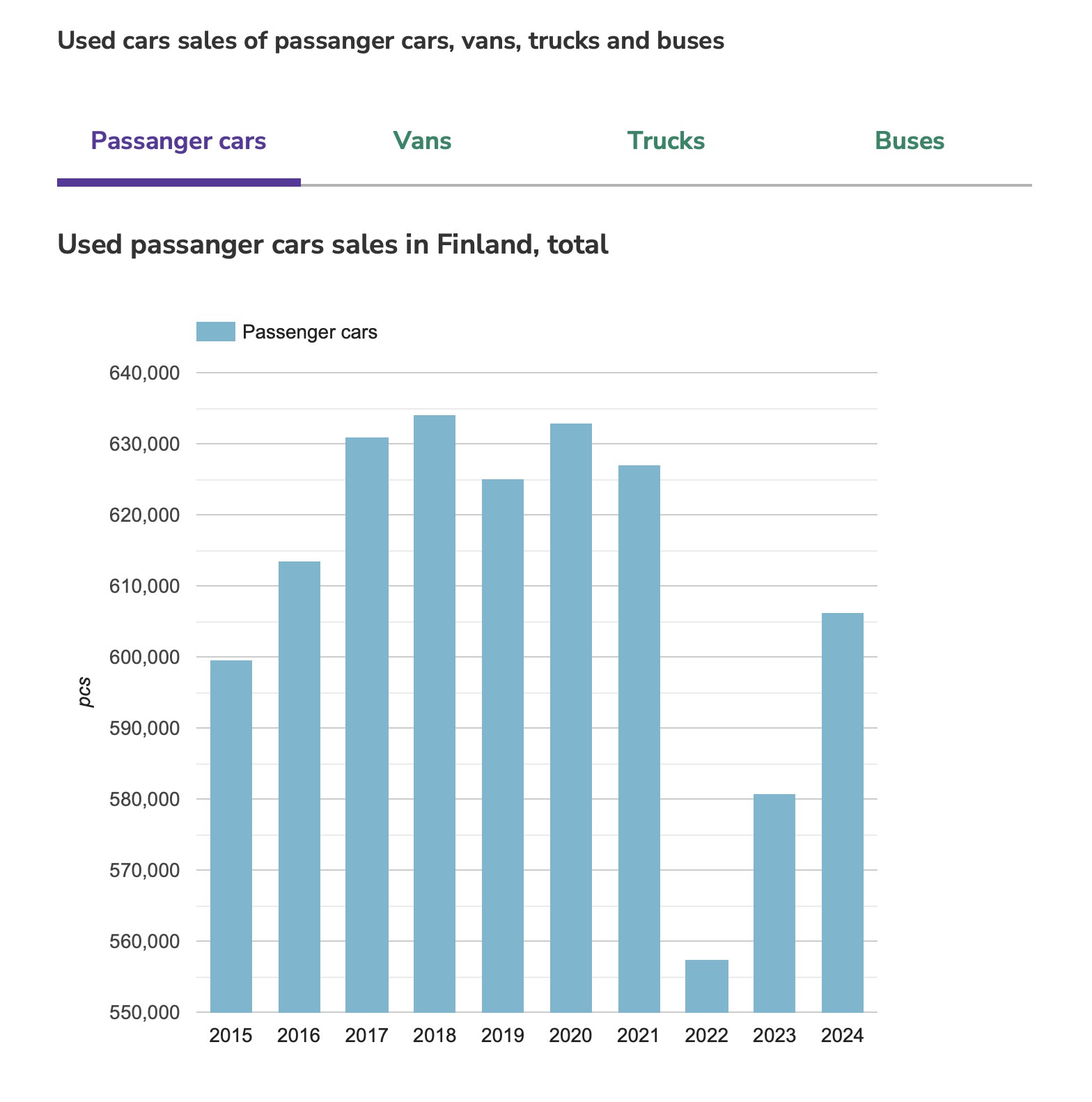

Before we go into the procedure for importing a car into Finland, let’s see if the demand makes it a good opportunity. According to Autoalan Tiedotuskeskus, used passenger car sales in Finland have remained strong for the last few years.

Image source: Autoalan Tiedotuskeskus

There was a drop in sales in 2022 due to automotive supply chain disruptions, but ever since, numbers have steadily increased each year, and we can expect the trend to continue in 2025.

This makes Finland a stable and active market for used cars, especially for petrol and diesel models, which still dominate the country’s car fleet.

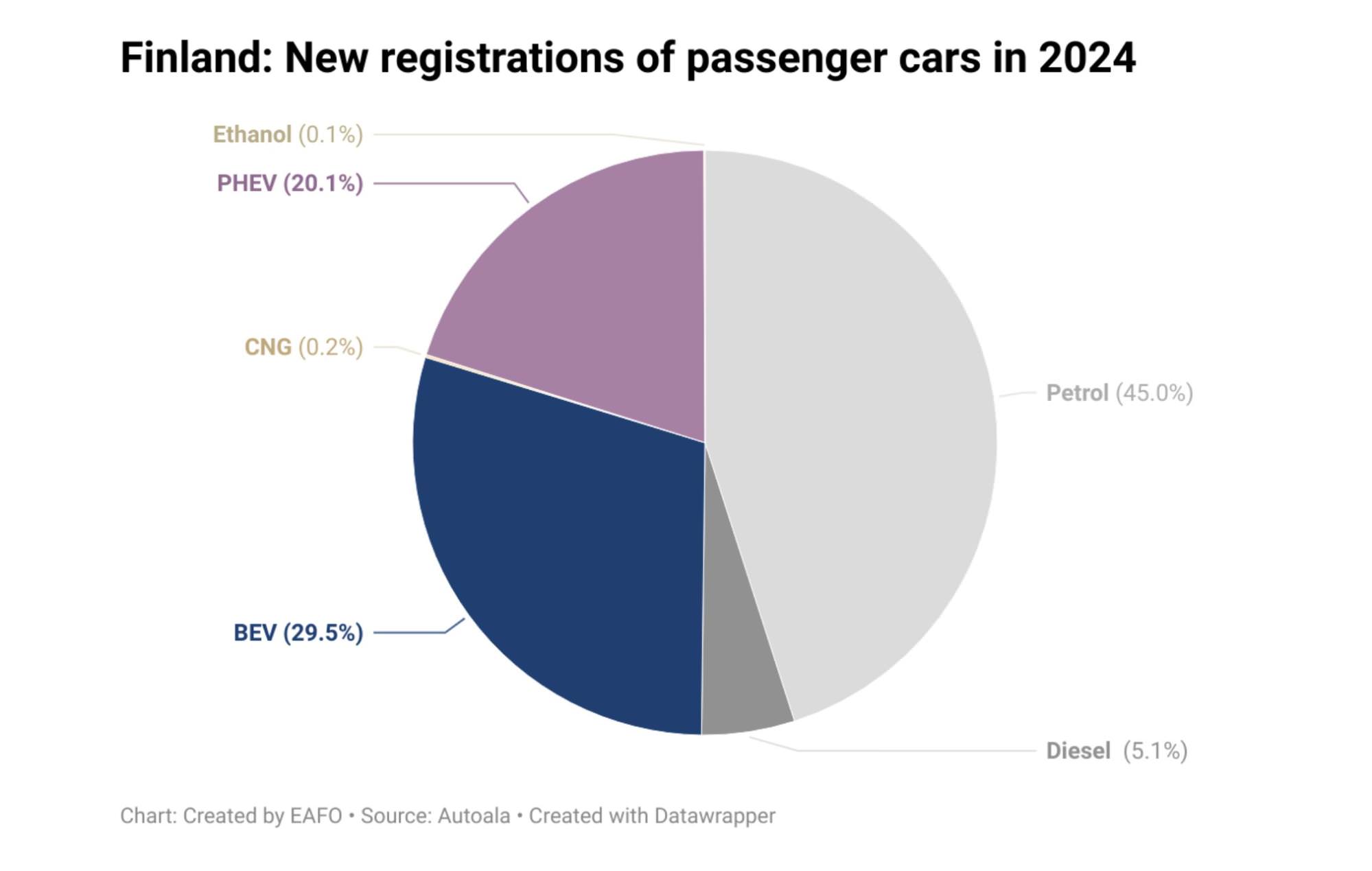

At the same time, the latest data on new passenger car registrations in 2024 shows a shift in buyer preferences. Petrol cars still lead the way with 45% of registrations, but BEVs have grown significantly, and now they make up nearly 30% of new sales. Plug-in hybrids (PHEVs) follow with a 20% share.

Image source: European Alternative Fuels Observatory

For used car dealers, these trends matter. While traditionally fueled cars still offer strong resale potential, growing demand for EVs means that you should also start paying attention to the availability and resale value of EVs and hybrids.

And if you’re looking for specific models that you could import and resell, take a look at this list of best sellers in Finland 2025. You’ll see that Finns love their Toyotas:

- Ford Transit Custom

- Toyota Yaris Cross

- Nissan Qashqai

- Toyota Yaris

- Toyota RAV4

- Volvo XC60

- VW ID.4

- Mercedes Vito

- Toyota C-HR

- Toyota Corolla

All in all, Finland offers a healthy used car market with steady demand. Let’s now see how you can take part in it by importing cars and selling them legally and efficiently.

Documentation for importing a vehicle to Finland as a business

Here’s a list of documents you’ll need to prepare to import used cars.

Vehicle purchase invoice

First, you’ll need to prove that the car legally belongs to you, and you can do that with the vehicle purchase invoice.

This is the sales document proving the transaction between you and the seller. It should include the buyer and seller details, vehicle identification number (VIN), make, model, and final price.

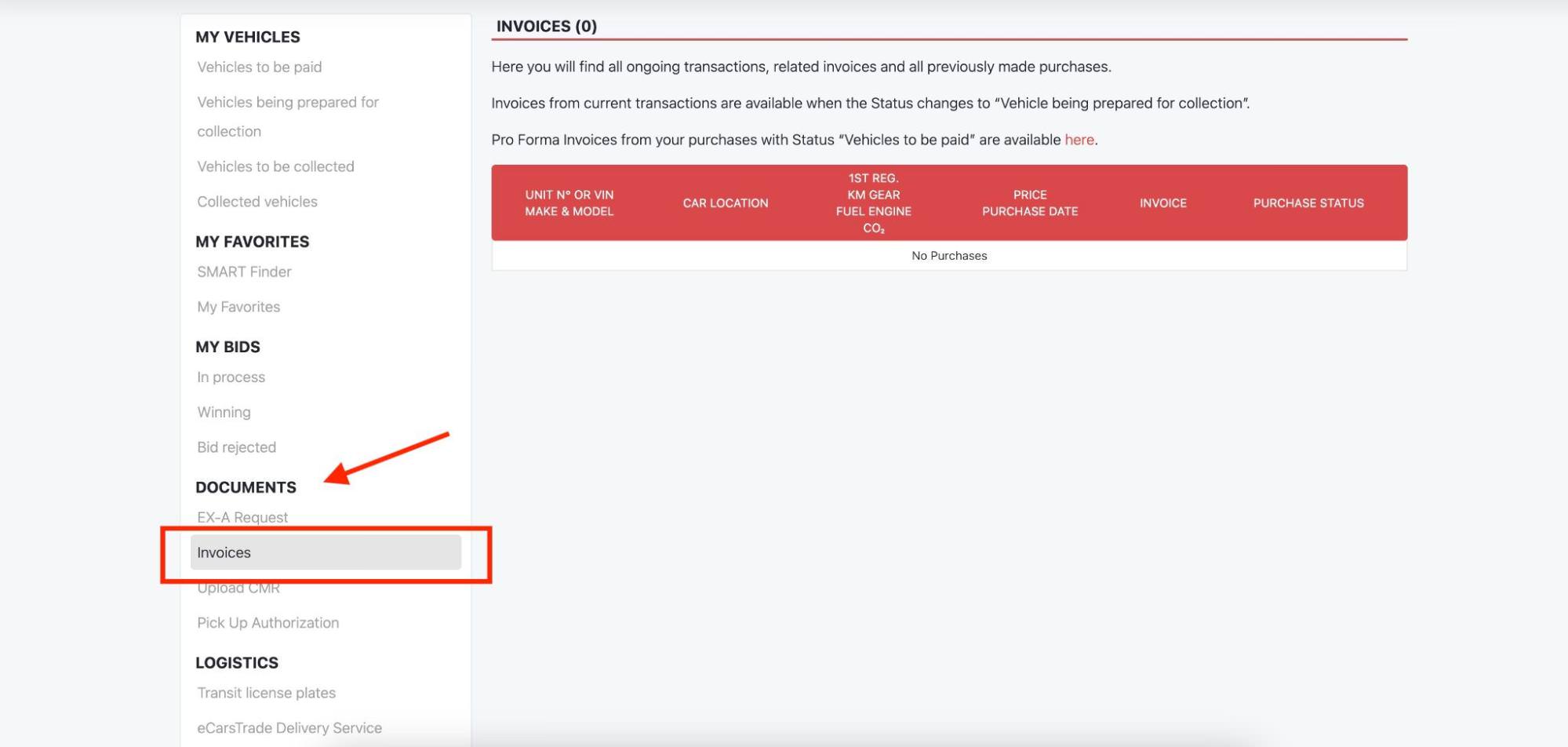

If you buy cars via eCarsTrade, you can access invoices on your Personal Page.

Original registration certificate

Next, you need to prepare the original registration certificate from the country of export to confirm the vehicle was previously registered.

Certificate of Conformity (COC)

You’ll also need the certificate of conformity (COC) of the car you’re importing. This document confirms that the vehicle meets EU safety and environmental standards.

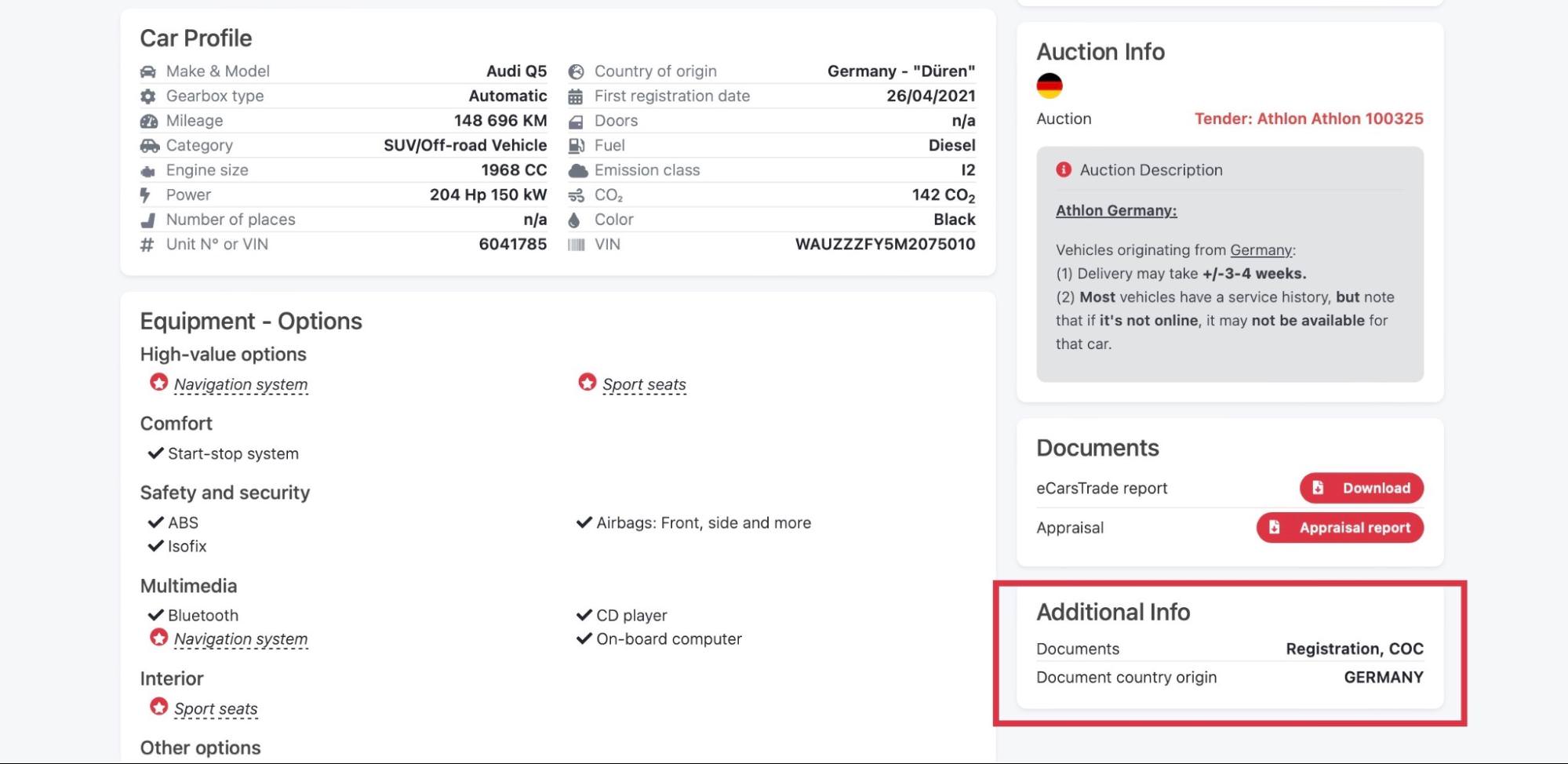

If you’re buying through eCarsTrade, some cars may come with the COC, which will be marked on the listing.

Still, some used cars aren’t sold with their original COC certificates. If that’s the case with the car you’re buying, you can buy the certificate from authorized providers like EuroCOC or COC Europe.

These services can deliver official certificates for most major brands, usually within a few days.

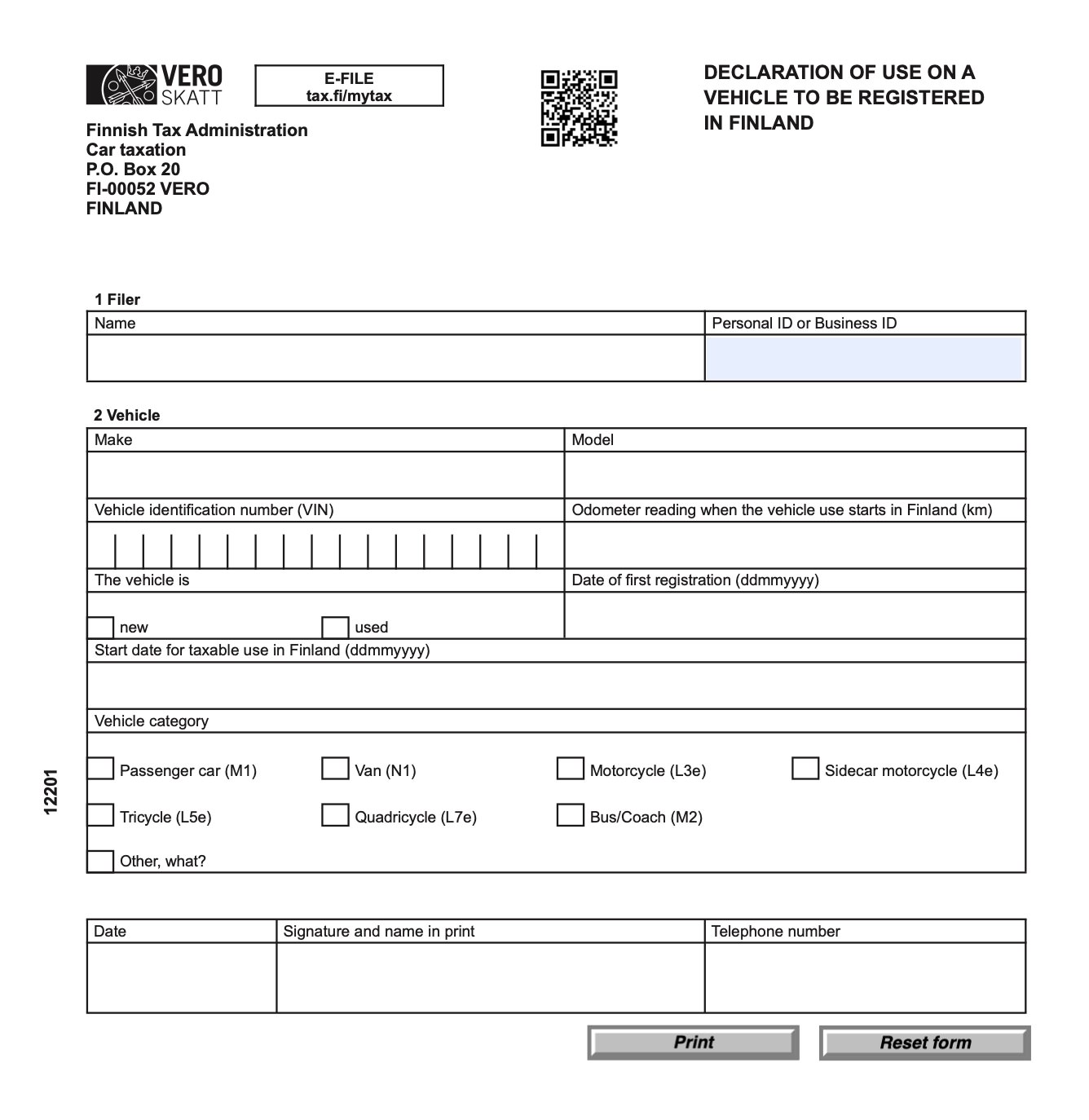

Declaration of use

In Finland, you must submit a declaration of use to the Tax Administration as soon as the vehicle arrives in the country.

You must file it through the MyTax portal before doing anything else with the vehicle, including inspection or registration. Don’t forget to take this step right after the car enters Finland, or you’ll be facing fines.

The declaration form looks like this:

Proof of identity

Lastly, you’ll need to prepare valid identification and proof of your business's registration in Finland.

Taxes when importing a car to Finland

Alright, you’ve sorted the necessary documents. Now, here’s a list of taxes and duties you’ll encounter when importing a car from abroad.

VAT

Just like in the rest of the EU, VAT rules depend on where you’re importing from and whether the car is new or used.

If you import a used vehicle from another EU country, you typically won’t pay VAT in Finland. You only have to pay VAT for new vehicles; those that are less than six months old or have under 6,000 km on the odometer.

If you’re importing from outside the EU, you’ll have to pay VAT in Finland, regardless of the vehicle’s age or mileage. The new standard VAT rate in Finland is 25.5%, and it’s calculated based on the total value of the vehicle, including transport and insurance costs. You must pay this amount to Finnish Customs before you can register the vehicle.

Customs duty for non-EU imports

You’ll also need to pay customs duty, usually around 10%, on vehicles brought in from outside the EU.

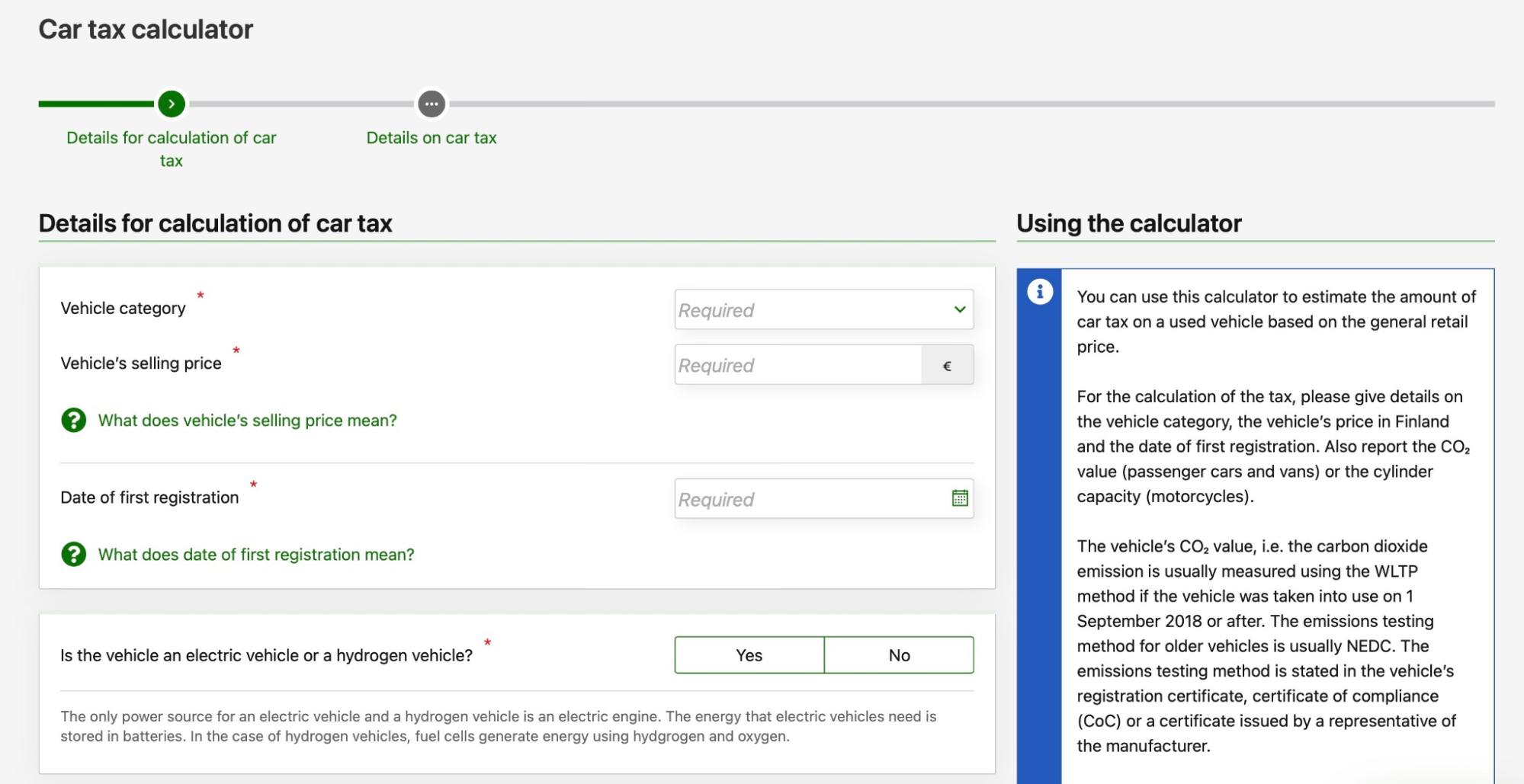

Autovero (the Finnish car tax)

Finland charges a car tax (autovero) when a vehicle is registered or taken into use for the first time.

You can use an online calculator to estimate the cost of the car tax.

To estimate the tax, you’ll need the following details:

- Vehicle category

- Selling price

- Date of first registration

- CO₂ emissions

- Odometer reading, make, and model

Step-by-step process - from purchasing a car to importing it to Finland

And with that, you’re ready to start buying and importing cars to Finland.

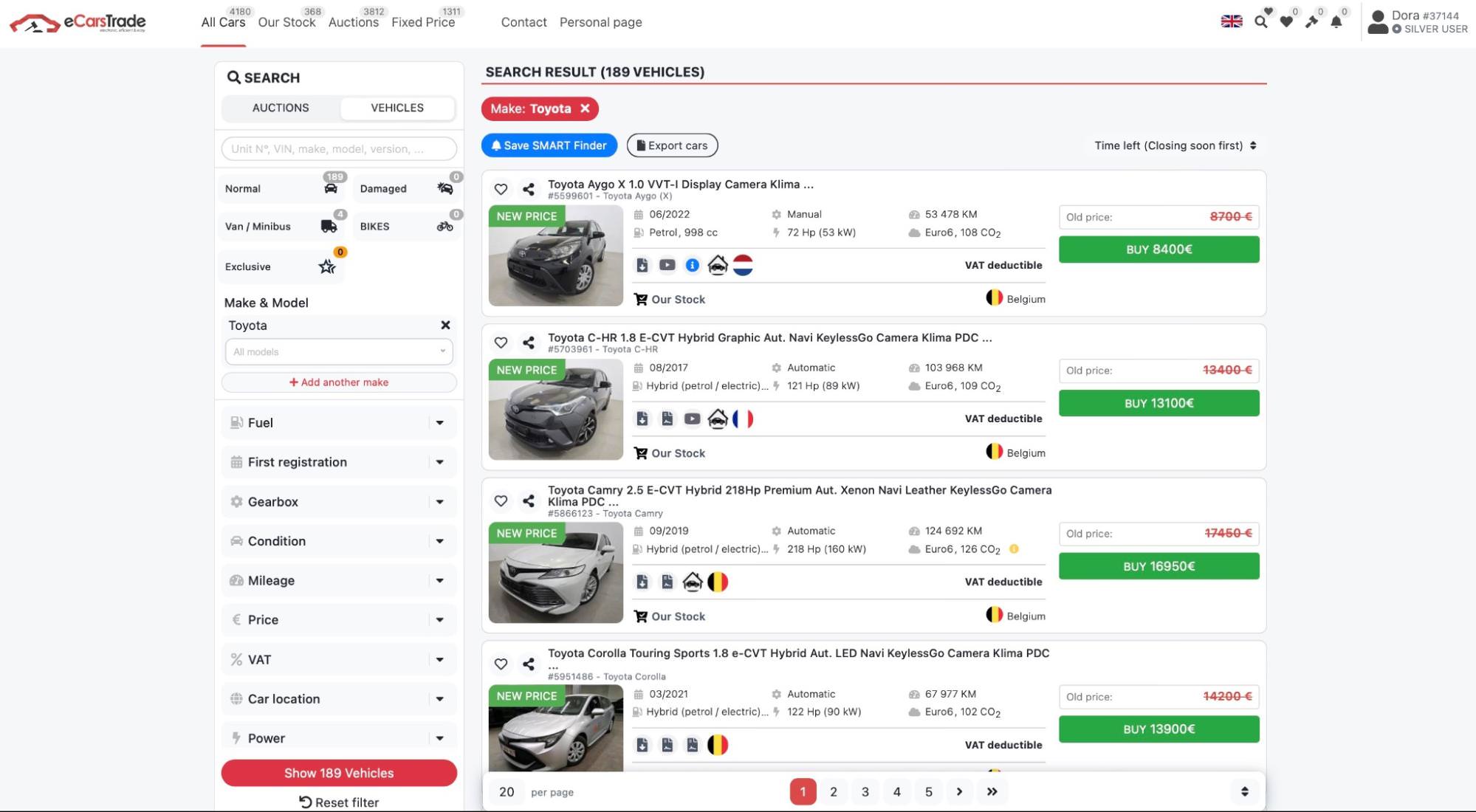

1. Research and buy the car

Your first step should be researching the local market and identifying the models that sell best.

As we’ve seen earlier, Toyotas perform well in Finland, so you could visit eCarsTrade to start your search online. Our online auction platform for ex-lease vehicles lets you filter cars by make, model, fuel type, and more, making it easier to find stock that matches your buyers’ needs.

Once you’ve placed your bid or bought at a fixed price, you can pay directly within the platform.

After payment, you will be able to download the purchase invoice directly from your Personal page, which you’ll need for customs and registration in Finland.

2. Arrange transportation to Finland

When you’ve secured the car, you’ll have to choose the method of transportation. Most dealers opt for the eCarsTrade Delivery Service because it’s convenient, affordable, and most importantly, completely hassle-free. We take care of the transport from start to finish, so you can focus on buying the right cars for your business

3. Obtain a Certificate of Conformity

If the car you’ve bought doesn’t come with a COC, now is the time to buy one from a certified provider.

4. Submit a declaration of use

Once the vehicle arrives in Finland, you must file a declaration of use with the Finnish Tax Administration.

You can submit the declaration through the MyTax portal. After you submit it, you’ll instantly receive a confirmation letter in MyTax, which you can print or save on your phone. Alternatively, you can choose to receive the confirmation by post.

Either way, you should keep the confirmation with you in case the police or Customs ask to see it.

5. Pay taxes

Depending on where the car comes from, you may need to pay customs duty and VAT (especially for non-EU imports). You’ll also need to submit a car tax return to determine and pay autovero, the car tax.

6. Do the registration inspection

Before registering the vehicle in Finland, you’ll need to take it to an inspection station for a registration check. This confirms the vehicle’s identity and technical compliance, so you should prepare the COC and the original registration documents.

Importing a car to Finland - FAQ

Do I need to submit a declaration of use if I’m not driving the car before selling?

Yes. Even if the car stays parked and isn’t used on public roads, you must submit a declaration of use as soon as the vehicle enters Finland.

Do I need to pay VAT on used cars from other EU countries?

Usually not. VAT only applies if the car is considered new (less than 6 months old or under 6,000 km). Otherwise, you typically won’t pay VAT when importing used vehicles from within the EU.

What if the car doesn’t come with a COC?

Don’t worry, you can always buy a Certificate of Conformity from authorized providers like EuroCOC or COC Europe.

Importare veicoli dall'Europa può essere complesso, ma eCarsTrade è qui per semplificare il processo. Scopri come: