- Blog

- How to Import a Car to Portugal

How to Import a Car to Portugal

Don't miss out on profitable car imports to Portugal. Get the step-by-step guide and knowledge you need on taxes, regulations, and insider tips today.

If you’re a car dealer from Portugal and you want to buy a car from eCarsTrade online auctions, you might be wondering how to import your car.

Navigating the import process for cars to Portugal might initially seem like a complex journey, especially for small to medium car traders.

However, we have prepared a guide to help you through this process, ensuring that you know the steps needed to import vehicles efficiently and legally into Portugal.

Keep reading to learn more about the various taxes, regulations, and procedures for successfully importing and reselling cars in Portugal.

Proper documentation is crucial for a hassle-free import

For a successful import process, you need to make sure that all required documentation is in order and that the vehicles meet Portugal's specific standards.

This includes having documents like the vehicle's registration, proof of purchase, and compliance certificates. Moreover, vehicles must conform to Portugal's emissions, safety, and technical standards.

It's simple - complete and correct documentation means you’ll have a smooth import process.

Portugal import regulations

The cornerstone of a successful vehicle import process is a thorough understanding of Portugal's specific import regulations.

In this guide, we will cover rules and regulations that apply to car dealerships or other businesses trying to bring cars into Portugal - for example, after buying a used car on eCarsTrade car auctions.

Let’s start!

Documentation required for car import

Here are all the documents you will need to import your car to Portugal:

-

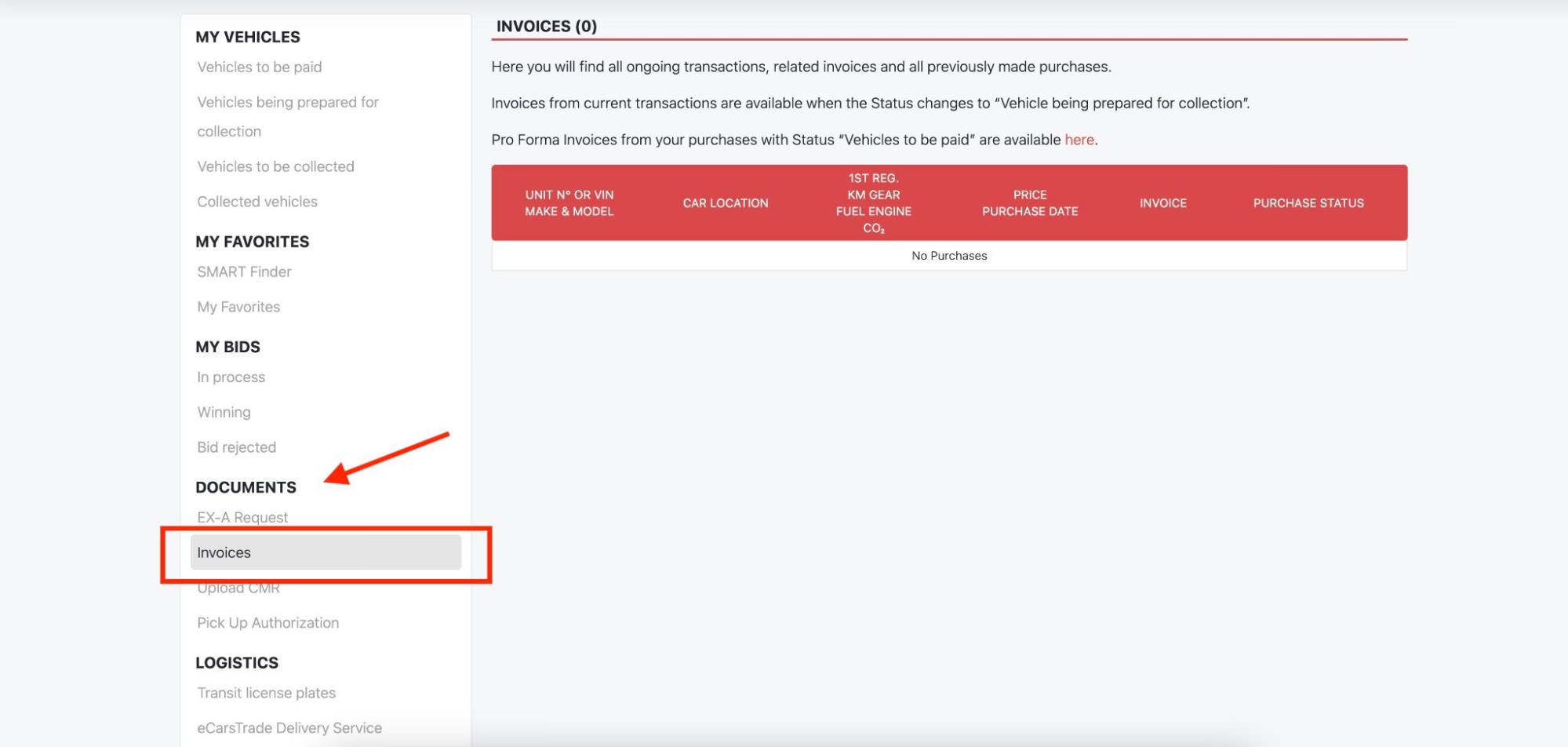

Purchase invoice

This is your proof that you have indeed bought a car from a dealership or an online auction platform. You can download all your invoices through your Personal Page on eCarsTrade.

-

Car registration documents

Every eCarsTrade car comes with original car registration documents. We can provide all the car’s original documents in several ways. We can either provide them upon pick-up or mail them to your chosen address.

-

Certificate of Conformity (COC)

A Certificate of Conformity is a document issued by the car manufacturer stating that your car complies with technical, safety, and environmental regulations. It is essential to the import and registration process.

Sometimes, a dealership won’t be able to provide you with a COC. At eCarsTrade, the availability of the COC depends on the vehicle’s country of origin.

For example, most of our cars from Belgium and Luxembourg have a COC. Vehicles from The Netherlands and Germany have a COC, but it’s not the original brand’s COC. Cars from France rarely have a COC.

► What to do in case your purchased car doesn’t have a COC?

You have several options to get a COC if you didn’t get it with your car:

1) Contact the car's brand to ask if they can provide a COC for free or a fee

2) Order it from websites like EuroCOC

3) Entities in Portugal that deal with car registration and legalization will be able to obtain the COC on your behalf.

-

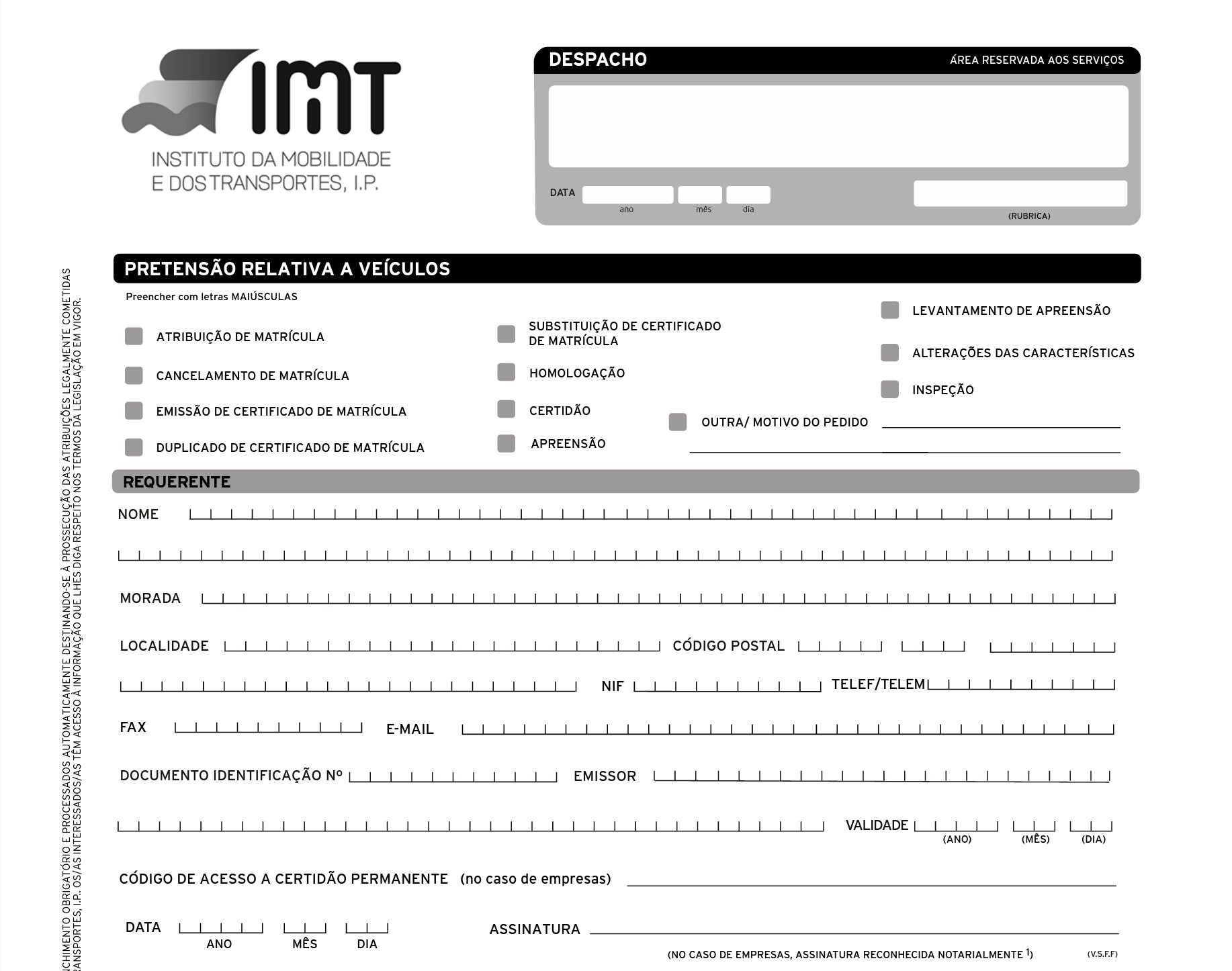

IMT form Model 9

IMT form Model 9 by Instituto da Mobilidade e dos Transportes (IMT) will be necessary to complete the car inspection required for all imported cars.

IMT Model 9 form

-

Model 112 inspection certificate

You will obtain this certificate after you do an inspection of your imported vehicle.

-

Customs Certificate (DAV)

DAV stands for Declaração Aduaneira de Veículo. It is a declaration that must be completed whenever a vehicle is imported into Portugal.

Every vehicle brought into Portugal needs a DAV declaration, even if you don’t plan to register it. You can fill out the form on SFA2 (Sistema de Fiscalidade Automóvel versão 2).

Customs, import tax, and VAT

Knowing all the details about tax, customs, and VAT will be crucial not only to your importing process but also to making a profit on the cars you source.

VAT

On eCarsTrade, most of our prices are VAT excluded, which means that EU companies - in this case, Portuguese companies - have to buy vehicles with the VAT excluded and then declare the VAT in Portugal.

If your car dealership sells to private customers, you will need to keep VAT in mind as you make your profit calculations.

Let’s run a simple calculation to illustrate the point. Let’s say you buy a car on eCarsTrade for 10,000€ and want to make a profit of 2,000€ on that car.

You will need to add 23% VAT, plus any other transport and import expenses, to this cumulative total of 12,000 euros. This will be your dealership's final price to a customer who buys a used car.

CUSTOMS DECLARATION

All cars in Portugal are imported through the Portuguese Tax and Customs Authority (Autoridade Tributária e Aduaneira).

When your car arrives in Portugal, you need to fill out a customs form — the DAV form we mentioned previously. This form asks for information about the car, its origin, and its intended use.

IMPORT TAX (ISV)

Vehicle import tax (Imposto Sobre Veículos - ISV) is usually a maximum of 10% of the vehicle’s value.

The ISV is determined based on the vehicle’s engine cubic capacity and CO2 emissions.

! Be extra careful when declaring the vehicle’s CO2 emissions and be aware whether you’re importing a car with an older WLTP value or the new NEDC value. Consult our guide on CO2 emissions and how to figure out whether your car’s CO2 values are WLTP or NEDC.

The good news is that you will pay the ISV only once, when the vehicle gets a Portuguese license plate.

Certain types of vehicles can have a discount on the ISV tax:

- EVs are exempt from ISV and IUC

- Hybrid cars have a 40% discount on ISV

- Plug-in hybrids have a 75% discount on ISV

- Natural gas cars have a 60% discount on ISV

- 7-seater cars are also entitled to a 60% discount on the ISV

Certain additional conditions apply on these exemptions, all of which you can check in this Portuguese guide to ISV and ISV discounts.

For a clearer understanding of the ISV and to calculate how much you can expect to pay, check the ISV’s official website.

Portugal import tax calculators

To estimate costs, you can use official calculators or apply the simplified formulas below:

-

VAT formula:

VAT = Vehicle Price × 0.23 -

ISV formula (simplified):

ISV = (Rate per cc × Engine Capacity) + (Rate per g/km × CO₂ emissions)– reductions -

IUC formula (simplified):

IUC = Base Rate + (CO₂ component × g/km)

► Try the official tax calculators here:

Legalization - An administrative procedure for vehicle imports in Portugal

The administrative process of making a car 100% compliant with Portuguese regulations is called car legalization.

As a car trader, you can either attempt to do it yourself or use a “dispatcher” (a broker) - a specialized entity that handles the legalization process for you. Using a dispatcher is a completely legitimate way to handle the importation process.

We recommend you use a dispatcher, as the process of doing it independently can be very time-consuming and complicated.

You can find a dispatcher by going to Ordem dos Despachantes Oficiais and searching for one in your area.

Here are all the steps of car importation you need to know about, whether you choose to do the process independently or hire a broker to do it for you.

Step-by-step guide: From EU purchase to import

1. Buy your car at eCarsTrade online auctions

This step is easy! Bid in our online auctions or buy directly from Our Stock. Once we receive the payment fro your purchase, we will start the process of transporting your car to our parking in Belgium.

2. Organize transport to Portugal

When the car is ready for pick-up, simply tell us if you want us to organize delivery or if you want to send a truck transport to pick up your car.

3. Obtain a COC

If the car you bought doesn’t have a COC, you will need to get one of the ways we mentioned previously — requesting it from the brand, ordering from EuroCOC, or getting it through your dispatcher.

4. Get your car inspected

In order to bring a car into Portugal, you will need to get it inspected at a Category B technical inspection centre. For the inspection, you will need these documents:

- Registration papers (Documento Único Automóvel - DUA) from the country of origin

- Certificate of Conformity

- IMT Model 9 form

You will get a model 112 inspection certificate, which confirms that your vehicle can safely drive on Portuguese roads.

5. Homologation of the COC

After the inspection, you need to get your COC homologated by the IMT. This means that everything in the COC really matches your car and its technical characteristics.

You will have to go to the Mobility and Transport Institute (IMT) with the completed IMT Model 9 form, the DUA (registration papers) of the country of origin, and the COC.

COC homologation is free and you will obtain a national homologation/approval number (número de homologação nacional).

6. Fill out the DAV form to pay the ISV tax

After the car has been inspected and you received the national approval number, you need to fill out a customs declaration called Declaração Aduaneira de Veículos (DAV). You can fill this form out online on the Portal Das Finanças (Finance Portal) or go to Customs in person.

To successfully complete this step, you will need:

- Model 112 inspection certificate

- IMT Model 9 form

- Registration papers (DUA) from the country of origin

- National approval number

- Purchase invoice

If you do this process at Customs, they will give you the ISV vehicle tax (Imposto sobre Veículo) settlement note, and you will have 10 working days to make the payment.

If you do this process online on the Finance Portal, you must issue the DUC (Documento Único de Cobrança) to pay the ISV. You will need the DAV form to finalize this step.

At this stage, you will also need to pay the VAT.

7. Register the car

After paying the ISV, you will need to request your registration certificate.

You will need:

- Certificate of Conformity (COC)

- IMT Model 9 form

- Model 112 inspection certificate

- Registration papers (DUA) from the country of origin

You can make this request online on the Automóvel Online portal or in person at a Registry Office.

8. Make your license plates

As soon as you receive your new registration number, you can go to a specialized shop to have the registration plates made.

9. Pay the IUC

From the moment the car receives plates, you have 90 days to pay the IUC tax (Imposto Único de Circulação), which is paid annually. You can do this in person or again through Portal Das Finanças.

Buying a car in Portugal with eCarsTrade

If you are a dealer in Portugal, eCarsTrade makes buying cars simple and profitable. Our platform gives you direct access to thousands of ex-lease vehicles from all over Europe, ready for import into Portugal.

-

Participate in Open Auctions with transparent bidding.

-

Try Blind Auctions for competitive deals.

-

Buy instantly through Fixed Prices.

-

Access Our Stock for an exclusive stock of our own vehicles ready for immediate purchase.

The process is straightforward: register for free, browse vehicles, place your bids, and arrange transport to Portugal. Our team assists with documentation and delivery, making cross-border car sourcing easier than ever.

Frequently Asked Questions

► Can I rely on support from eCarsTrade for import guidance for Portugal?

We will help with delivery and explain the entire process. Your Account Manager will suggest working with a dispatcher for the legalization process and a smooth import experience.

► Are there tax exemptions for importing a used car to Portugal?

Yes, certain vehicles have discounts on the ISV tax, such as EVs, hybrid cars, plug-in hybrids, natural gas cars, and seven-seater cars.

► How long does the car import process from the EU to Portugal take?

If you are using a dispatcher for the import process, the first part of the process will be completed 4-6 days after the car arrives in Portugal. This is important because car traders can already sell the car at this point—the legalization process doesn’t need to be fully completed for the trader to be able to sell the car. The entire legalization process can take up to a year.

Get to know the Portuguese car market

Importing cars is a huge business in Portugal. According to ACAP's annual balance sheet, in 2022 104,908 passenger cars were registered that "already had a registration in another state" and in 2023 Portugal’s top import were cars and other motor vehicles.

Being part of the European Union offers an advantage in terms of importing cars into Portugal due to the harmonization of regulations across member states.

This EU-wide framework simplifies the movement of goods, including vehicles, making it much easier to bid on used vehicles from Germany, France, or The Netherlands rather than importing cars from outside the EU.

However, while EU regulations simplify everything, importers still need to be aware of Portugal’s specific regulations and requirements.

From specific documentation to compliance with local standards - we’ll talk about it all!

All you need to know about how to import a car to Portugal

Importing a car to Portugal may initially seem complex, but with the right guidance and patience, it becomes pretty straightforward.

This guide has walked you through the key steps, documents and forms you need to have and where to find valuable online administrative information.

Whether you're an experienced business in the automotive trade or looking to expand into vehicle importation, the journey towards successfully importing cars into Portugal is full of opportunities.